built for advisers

Tech-enabled

Financial Advice

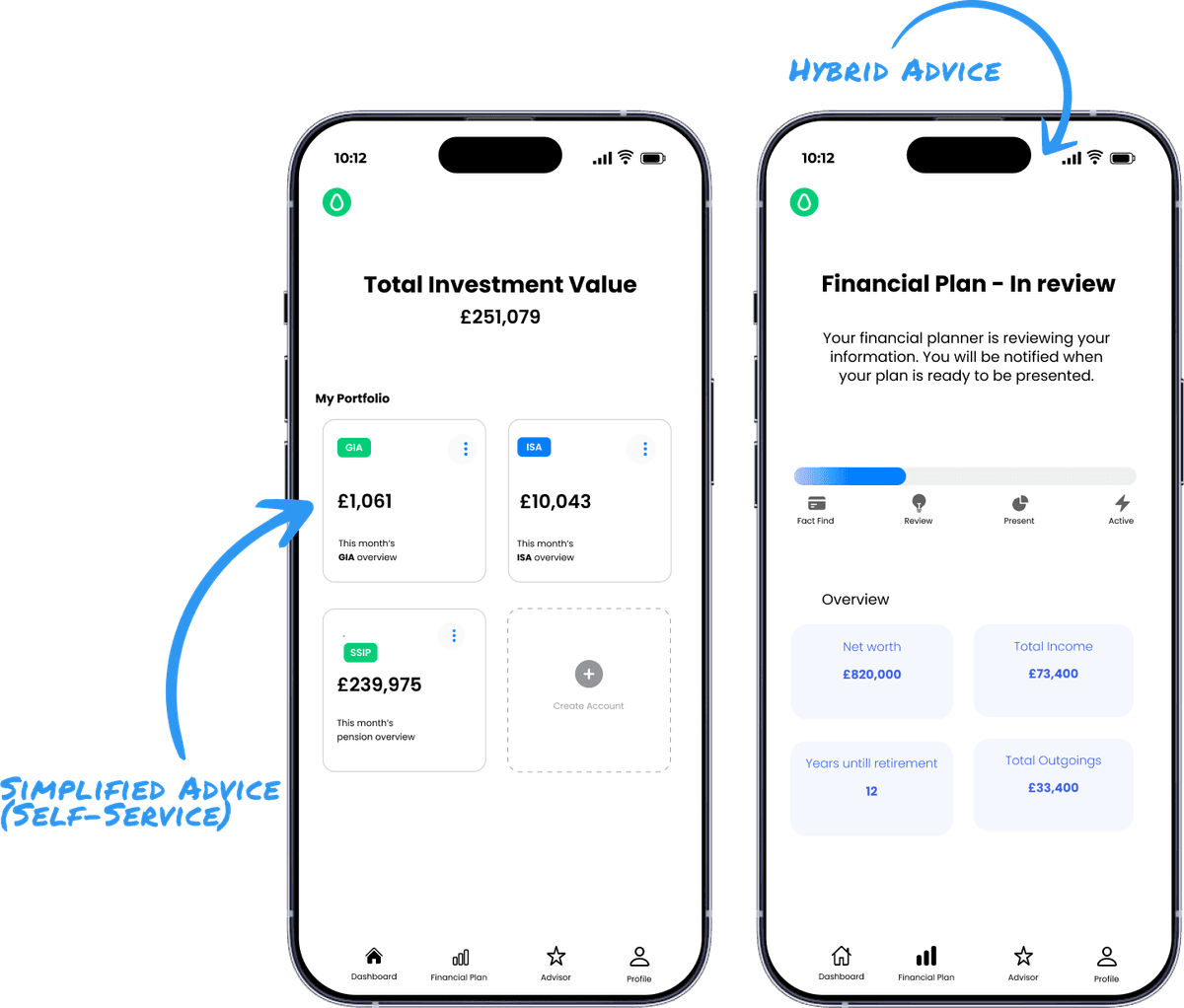

Our off-the-shelf Hybrid and Simplified Advice solutions allow regulated financial advisers to service anybody, enabling you to close the advice gap and scale your expertise to a far wider audience

Service anybody, profitably.

How It Works

Our digital-first workflows are designed to be delivered alongside your existing offering and allow you to service anybody, whether they're looking to start their investing journey or access your expertise for more detailed advice.

- Ideal for clients with

- £20k-£100k

- Client live and invested via your chosen investment proposition

- 9 min

- Minimum Adviser Input

- 0 min

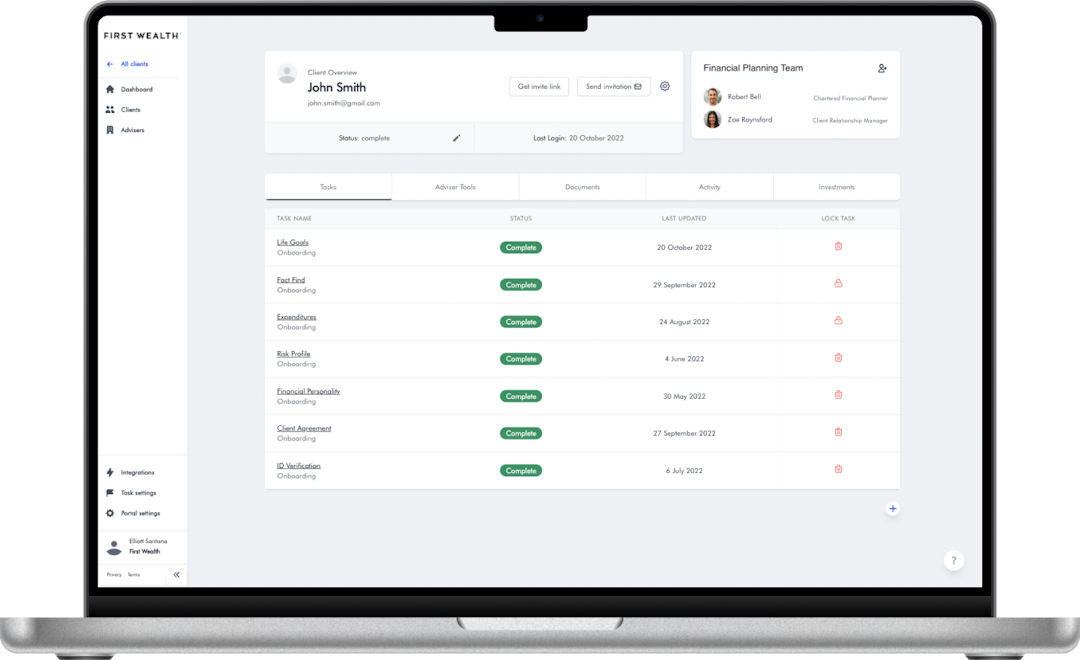

1. Register

2. AML

3. Investor

Profile

4. Account

Opening

5. Suitability

6. Ongoing

Management

7. Engagement

8. Hybrid Advice

1. Register

2. AML

3. Investor

Profile

4. Account

Opening

5. Suitability

6. Ongoing

Management

7. Engagement

8. Hybrid Advice

Register

- Branded sign up forms you can use anywhere

- Compliant client agreement built for your firm

“Open Advice has revolutionised the way we service new clients as well as automate the annual review process for existing clients. By embracing this technology, it has helped us save time and be able to engage with clients more effectively.”

Configurable workflows to meet every need

Everything you need to service anybody digitally

Terms of Business

- We'll provide compliant Terms of Business you can use to engage Simplified and Hybrid clients, as well as a Docusign integration for when clients are ready for your full service.

Investing Profile & ATR

- Out of the box psychometric risk profiling, insight into sustainability preferences and alerts to any vulnerability triggers.

Simplified Advice

- Operate a truly self-service product using your own CIP or our off-the-shelf investing solutions, allowing clients to invest via GIA, ISA or SSIP

Hybrid Advice

- Our Hybrid advice process digitises your expertise and automatically prompts recommendations based on a clients unique circumstances

ID Verification and AML

- Automated KYC, including sanctions, PEP and adverse media

Investment Platform

- One click account opening for adviser managed or Hybrid clients via our deep integration with P1 Investments

Secure Messaging

- Encrypted messaging via the platform to share resources and drive annual compliance reporting.

Open Banking

- Automated analysis of your client’s income and expenditure. Facilitation of secure payments into investment accounts and/or advice fees

Client Mobile App

- A one stop shop for your client to access Simplified and Hybrid Advice, as well as facilitating on going engagement.

Documents Hub

- Request and share documents with you clients through our documents hub.

Suitability Letters

- Automated Suitability letters for Simplified and Hybrid clients

Letters of Authority

- Automated process for gathering data on existing policies, including BR19 authorisation to obtain state pension forecasts.

Powerful Integrations

Connects with your existing tools.

Frequently asked questions

If you can’t find what you’re looking for email our support team here.

- Can I use your your software for just Simplified or Hybrid Advice Clients?

- Yes, we're able to lock down the app so that you can determine whether to accept Simplified or Hybrid clients. You can even do this on a client-by-client basis.

- Who owns the client relationship?

- You do! We just act as a software provider. If you decide Open Advice is no longer a good fit for your business you are able to export all your client information and continue servicing those clients however you see fit.

- Can I still use your software with out a centralised investment proposition?

- Yes, you are able to use either the P1 Evidence Based Investing portfolios (Including an Evidence Based ESG range) or any of the P1 Investment portfolio options.

- Can you provide documentation on your Simplified and Hybrid Advice processes for our compliance team?

- Of course, we have a full suite of documentation available for you to review. Please request a demo bellow and we will be intouch to discuss your requirements.

- Do I need an existing relationship with P1 Investments?

- No, we can make all the arrangements necessary for you. We just need some information about your firm to ensure you have the required regulatory approval.

- How much does your software cost?

- We currently charge £5 per month/client for all clients, whether they are Simplified, Hybrid or Fully Managed.

10, Dolphin Centre,

1st and 2nd Floors Brownsea House,

Poole BH15 1SP

Book a demo

Leave your details and one of the team will be in touch.